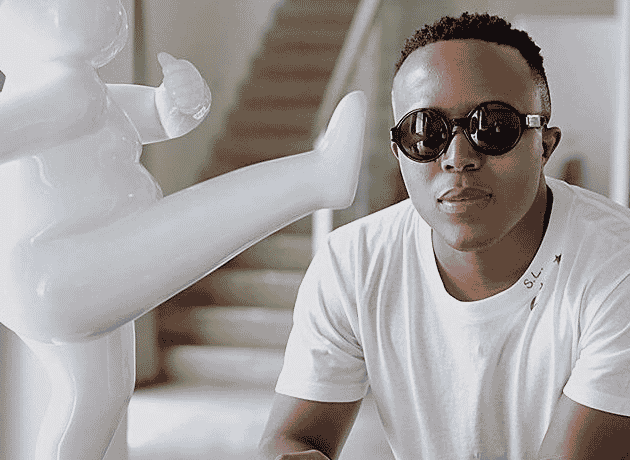

Young Gauteng businessman, Hamilton Ndlovu is learning the hard way that flaunting your wealth on social media is only for the law abiding citizens as SARS has discovered that he may have avoiding paying taxi amounting to at least R36m.

The Pretoria high court made final a provisional order obtained by the SA Revenue Service (Sars) against the businessman to freeze his bank accounts and seize some of his luxury cars.

Ndlovu leapt into the public domain in May 2020 after posting video footage online and boasting about buying a fleet of luxury vehicles worth about R11m. The fleet included three Porsche vehicles, a Jeep and a Lamborghini Urus SUV.

Sars took a keen interest in Ndlovu’s affairs when he flaunted his flashy lifestyle and apparent wealth.

“He thrust himself out of obscurity by doing two things. First, in May 2020 he bought five luxury vehicles at about the same time some of the other respondents received payments for lucrative contracts with the National Health Laboratory Service (NHLS). Then he bragged about this feat on social media,” Gauteng acting deputy judge president Roland Sutherland said when handing down the order.

Subsequent to Ndlovu making his lifestyle public, Sars obtained a provisional preservation order against him and five associated companies.

He is the sole director of two of the companies cited as respondents in the matter and is allegedly linked to the others by “collaboration”.

The provisional preservation order resulted in the seizure of several assets, including cars, and the freezing of bank accounts.

Sars then approached the high court to confirm the provisional order, a move opposed by Ndlovu.

The Hawks, according to court papers, are investigating whether personal protective equipment (PPE) contracts obtained by companies linked to Nldovu were legally granted.

The diversion of huge sums of money among businesses supports the inference of all of them being mere alter egos of one person and implies strongly that shady dealings are likely.

During its investigation into Ndlovu’s financial affairs, Sars discovered there were flows of money to and from one or more companies.

Sars also discovered the tax and VAT affairs of some of the companies were not in order. He has since been designated as a non-compliant party, after it was calculated that he owes the taxman R36 million in unpaid bills.

“Not only were returns outstanding, some for several years, but the income streams, especially payments from the NHLS to several respondents, could not be matched with the VAT, that would, by inference, be due and payable,” the court held.

Sars concluded Ndlovu allegedly used entities linked to him as alter egos “to spread potential liabilities and evade the scale of liability from progressive tax sales”.

“The diversion of huge sums of money among businesses supports the inference of all of them being mere alter egos of one person and implies strongly that shady dealings are likely,” the court found.

Companies linked to Ndlovu, according to the court, failed to explain a rational business model to justify cash flows.

The court contended the opinion of Sars that a preservation order was required and was reasonable.

“The provisional order of September 10 2020 is confirmed and made final,” it ruled.

Recently posted jobs

-

Ultra-heavy Motor Vehicle Driver | Standerton

Astral - GoldiStanderton -

Ultra-heavy Motor Vehicle Driver | Johannesburg

UnitransJohannesburg -

Warehousing Manager | Durban

BP Durban WarehouseDurban -

Ultra-heavy Motor Vehicle Driver | Springs

DistellSprings -

Code 14 Heavy Duty Driver Wanted | Midrand

Premier FMCGMidrand -

Code 10 Driver Wanted | Sasolburg

Plaas KoopSasolburg -

Ultra-heavy Motor Vehicle Driver Wanted | Pretoria

Admin FoodsPretoria -

Ultra-heavy Motor Vehicle Driver Wanted | Worcester

EpolWorcester